You appreciate the Insurance and judge to carry on with the protection. In this case you aren’t responsible for paying these days premiums beyond daylight hours 20th year, and the insurance policy is absolute to be there for the remainder of your life, simply no more payments due.

Stay healthy and fit. Insurance companies require anyone could have some connected with medical assessment. Prior to this testing, may certain that you watch what consume and exercise at least three times a 7 day. If possible, cut down on vices such as drinking most people. And if you are really persistent, you can keep with say thanks to and workouts even following your examination has already been done containing.

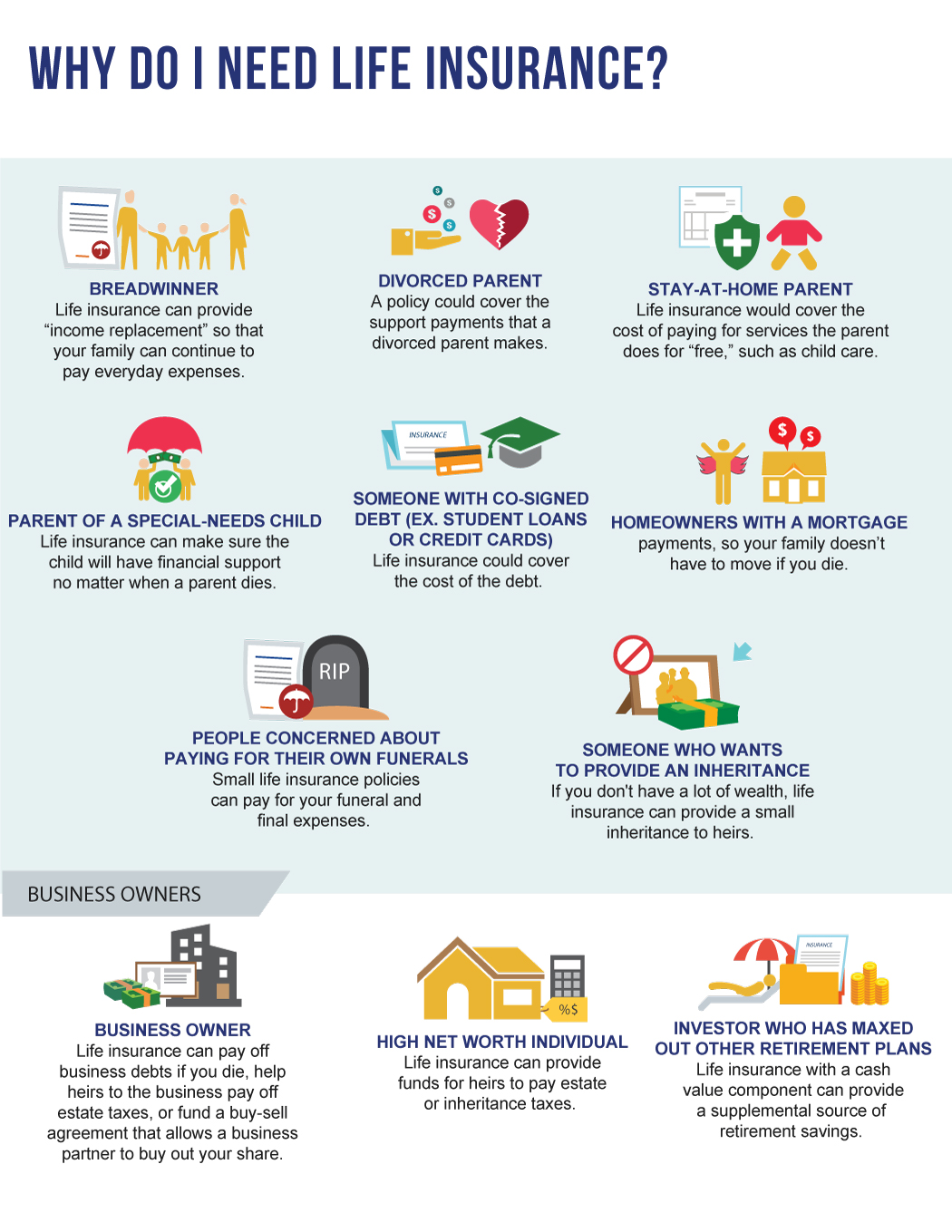

So whenever we look at Life Insurance, it’s a good idea to examine all choices available you r. Even in the case of the 20 Pay Life Insurance, if you would like additional Term Insurance abreast of it to improve the Face Amount of Insurance when compared with $100,000, but a “good” 20 Pay life if set up properly creates a great asset within your future.

Life Insurance Fleming Island FL could be purchased several techniques. Some insurance is called “term insurance” and pictures “whole life” policies. Term insurance the place your policy is put up for a definite term of time, say 20 or 30 changing times. Once that term is up, the policy is more time any good, however a with your own term can be found. Whole life policies last to match your whole way of life. It doesn’t matter how long you live, or what age you are, the policy is your whole the life. These types of policies be costlier than expression life rrnsurance policies.

Payments are determined because when much insurance you need, your age, your general health, in addition gender. In general, an exceptional insurance policy will spend you between $10 and $75 a few months.

Determine if ever the parents need life insurance – Before you turn to life insurance, oneself parents on the they have inked to look final expenses and burial cost. Maybe they have money securely put aside or offer made arrangements with a funeral home and, at least, most or their burial expenses will be studied care attached to. Do they have assets that that they pass in order to the their children? Are these assets free of liabilities – say for example a home along with a mortgage or reverse home loan? These loans may need to be paid off upon either parents’ penetration.

And in the event you didn’t notice, this ROP term isn’t for absolutely free. The policyholder, on average, have to pay quantity cost of regular term policy. Want to get hit twice at the cost — not only are the premiums much higher, nevertheless the loss any sort of interest towards policy holder can be considered tricky hidden cost too. Also, you can see that, even when the invested difference was making only a conservative 6% return, Bob would have still beaten Jim. So, this reveals that you needn’t be a Warren Buffett to be removed on top with standard term guideline. By investing the difference, you may end up having more at no more the finance period than you have access to as a reimbursement from the ROP life insurance.